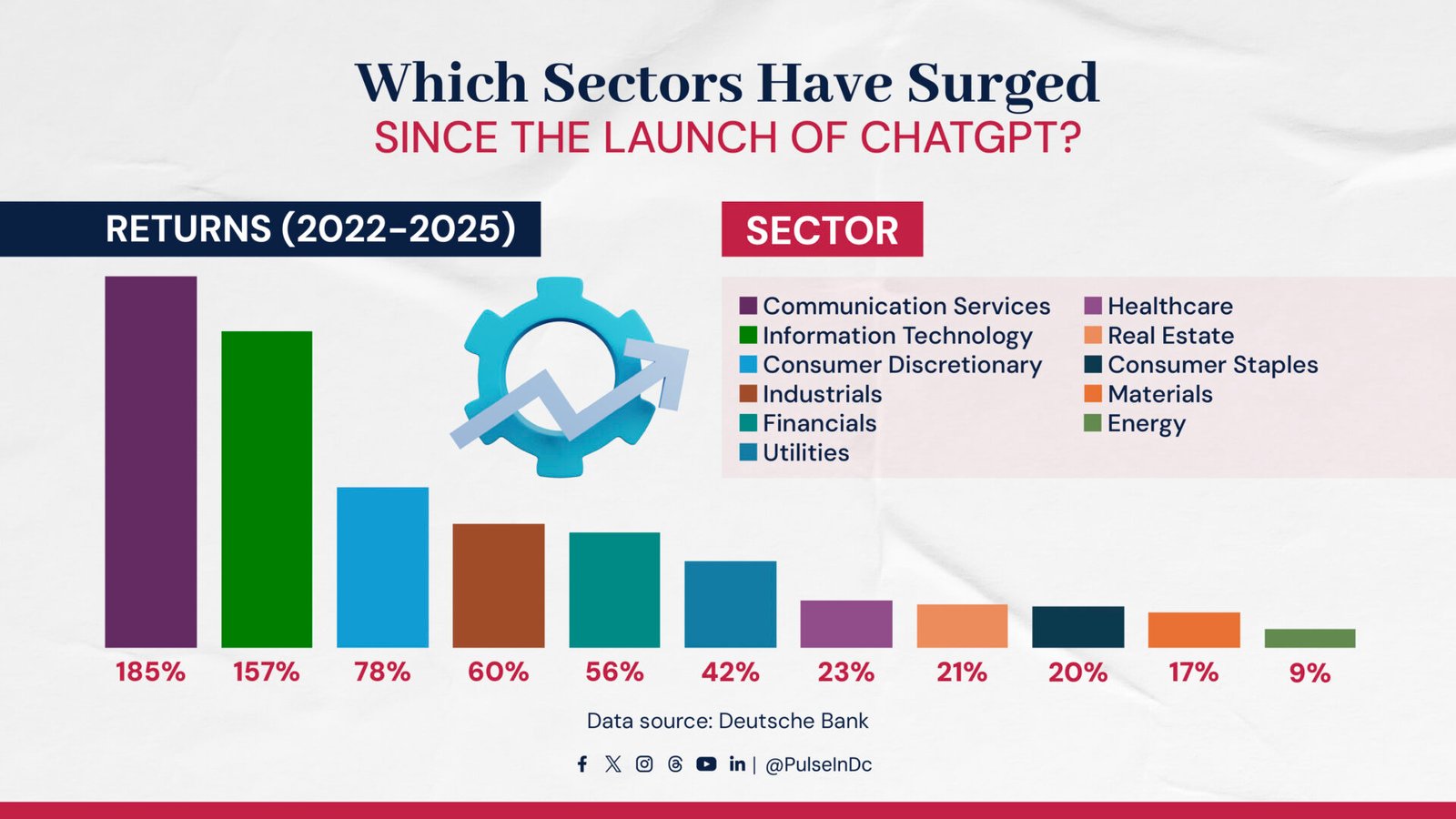

Which Sectors Have Surged Since the Launch of ChatGPT?

The launch of ChatGPT in late 2022 triggered a powerful and sustained shift in global investment behavior, marking one of the most transformative market cycles in recent history.

As the world recognized the disruptive potential of generative AI, investors funneled capital toward companies positioned to build, supply, or scale the new digital infrastructure needed to support this technology.

Communication Services led with a 185% return, driven largely by Meta’s massive rebound and its aggressive AI adoption strategy.

Information Technology followed with a 157% gain as chipmakers, cloud giants, and hardware specialists became essential pillars of the AI ecosystem.

Nvidia emerged as the standout winner, soaring over 1,020% thanks to unprecedented demand for its AI-optimized GPUs, while Broadcom surged more than 700% by dominating custom accelerators and networking hardware.

Consumer Discretionary also experienced strong gains as digital-first platforms leveraged AI to improve recommendations, logistics, and user experience.

Meanwhile, traditionally defensive sectors—including Utilities, Healthcare, Real Estate, and Consumer Staples—delivered comparatively modest returns, signaling a clear divergence in performance between AI-connected industries and those more sensitive to interest rates and slow-moving demand.

Together, the data shows how the AI boom, sparked by ChatGPT, radically reshaped market leadership and redefined which sectors—and companies—drive American innovation and growth.