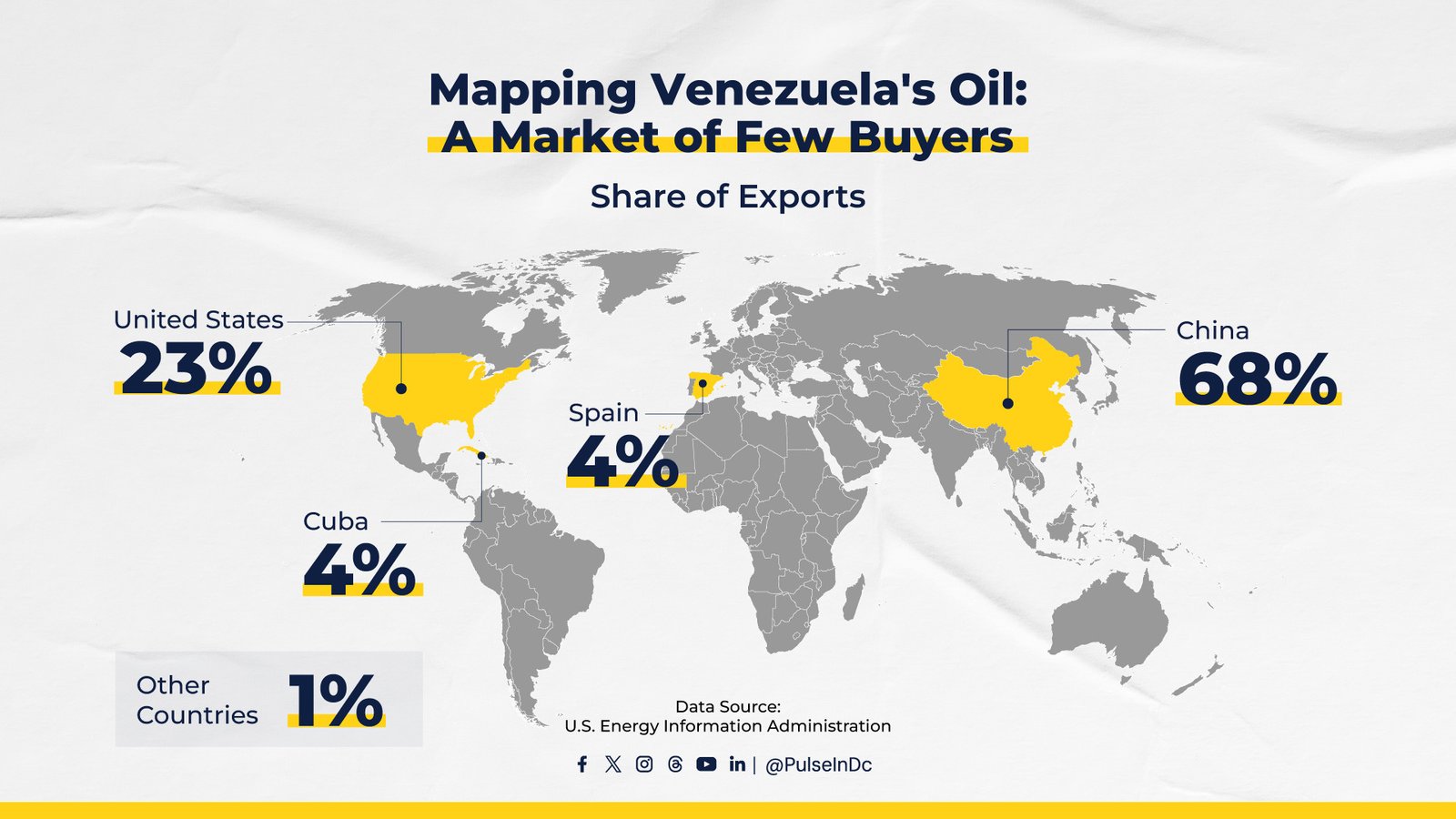

Mapping Venezuela’s Oil: A Market of Few Buyers

An analysis of 2023 export data from the U.S. Energy Information Administration lays bare the extreme and risky concentration of Venezuela’s most vital economic lifeline: its crude oil.

The visualization reveals an overwhelming dependence on a single nation, with China purchasing a massive 68% of all Venezuelan oil shipments, a direct result of Beijing’s strategic support for the sanctioned South American country.

The United States, despite longstanding political tensions, remains the second-largest destination for Venezuela’s heavy crude, importing 23% to feed its specialized Gulf Coast refineries.

Beyond these two giants, the export market evaporates, with only Cuba and Spain registering minor shares of 4% each, and all other global buyers—including nations like Russia and Malaysia—collectively accounting for a mere 1% of the total.

This lopsided trade picture underscores a critical vulnerability for Venezuela’s already crippled economy, demonstrating how its primary source of revenue hinges precariously on the stability of a single diplomatic and commercial relationship, leaving it exposed to geopolitical shifts and market pressures with very few alternative options.